Where Making Money – Meets Making a Difference

Our mission is to engage in global investing for positive social and sustainable impact through a conscious allocation of capital and shareholder advocacy.

High Impact Investing

A growing number of our investors seek to align their investments with their personal values. Individuals and institutions invest for different reasons. Some seek to grow their assets or generate income, while others are more focused on protecting the assets they’ve already accumulated. We believe the Ridgecrest Wealth Management High Impact Investment Philosophy supports all of these objectives. We help clients set and implement clear goals aligned with their needs, values, and objectives.

Ridgecrest Wealth Management is striving to be a leader in sustainable and responsible investing.

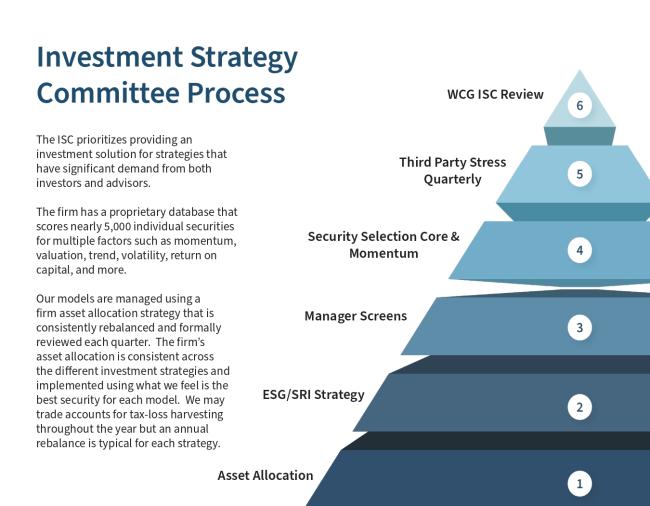

ESG analysis enables us to gain insights into a company’s:

Environmental Focus

Resource Management, Climate Change, Emission Reduction

Social Issues

Workplace safety and equity, Product Integrity, Community Impact

Governance Practices

Executive Comp, Reporting, Board Structure, and Accountability

Our High Impact Portfolios (HIP) invest in companies and funds that are committed to sustainable business practices. There is a growing base of evidence that suggests environmentally sustainable companies, socially responsible, and have positive screens for corporate governance and diversity in executive leadership outperform funds that do not share this focus.

Comprehensive analysis supports our efforts to build portfolios made up of well-managed, forward-thinking companies.

At The Wealth Consulting Group, we invest in companies that are rooted in authenticity and dedicated to making a positive difference in the world. Our portfolios invest in companies that are committed to:

Developing innovative solutions to global sustainability challenges

Promoting gender, ethnic, and lifestyle diversity

Supporting community-based financial institutions that promote small businesses, health care, education, and housing

Actively involved in shareholder advocacy and public policy engagement

The return on ESG investments may be lower than if the adviser made decisions based solely on investment considerations.

Environmental Social Governance (ESG) has certain risks based on the fact that the criteria excludes securities of certain issuers for non-financial reasons and, therefore, investors may forgo some market opportunities and the universe of investments available will be smaller.