Weekly Market Commentary 05.23.2022

The Markets

On the fear and greed cycle.

One of the most challenging times for investors is a market downturn. Whether markets are experiencing a correction or a bear market, it’s really disturbing to watch the value of your savings and investments decline.

Last week, the CNN Business Fear & Greed Index showed extreme fear was the emotion driving investment decisions. The Index “is a way to gauge stock market movements and whether stocks are fairly priced. The theory is based on the logic that excessive fear tends to drive down share prices, and too much greed tends to have the opposite effect.”

During times like these, many investors succumb to fear and take actions that damage their ability to reach their financial goals. The fear and greed cycle works like this:

- Feeling greedy: During bull markets, everyone wants to invest. The market is moving higher, and nobody wants to miss out. As a result, investors become so enthusiastic that they are willing to pay higher share prices than companies may be worth. Former Federal Reserve Chair Alan Greenspan called this “irrational exuberance.”

- Feeling fearful: During corrections and bear markets, when the market is moving lower, no one wants to invest. Some investors become so concerned, they sell, which drives prices even lower. Investors who sell accept a loss of principal; a decision that can negatively affect their ability to reach long- and short-term financial goals.

It’s counterintuitive, but many think the time when investors should be greedy is when the market nears a bottom (4). That’s when it may be possible to find shares with strong fundamentals that are selling at attractive prices. Since no one really knows when a turning point will occur, investors who decide to buy low may experience losses before they realize gains.

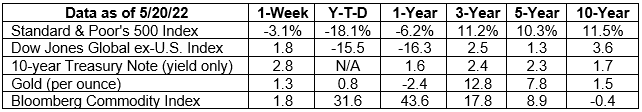

Last week, major U.S. stock indices moved lower.

If you’re feeling fearful, let us know. One of our most important roles is helping clients stay focused on financial goals, maintain a disciplined investment approach, and keep a long-term perspective in difficult markets.

ABOUT LOSS AVERSION, BEAR MARKETS AND RECESSIONS…

Here’s something to remember during volatile markets when the desire to sell may be strong: Our brains are hard-wired to avoid loss. Studies have found the pain of loss is far more powerful than the pleasure of gain. This is called loss aversion.

Overcoming loss aversion isn’t easy. One thing that may help is understanding a situation more clearly. For example, knowing more about bear markets may help reduce the fear of these market declines. Here are some facts to consider:

- Bear markets are not uncommon. There have been 11 bear markets since 1956, reported Mark Kolakowski of Investopedia. The shortest bear market lasted one month (February 2020) and the longest was 31 months.

- Bear markets are price declines or 20 percent or more from a previous peak, reported Georgina Tzanetos of Bankrate. A major stock index (like the Dow Jones industrial Average, Standard & Poor’s 500 Index or Nasdaq Composite), an asset class (stocks, bonds, etc.), or an individual stock can experience a bear market.

- Bear markets sometimes precede recessions, but not always. Stock markets reflect what investors think may happen in the future. When they drop, it’s often because investors see hard times ahead. Eight of the last 11 bear markets have occurred before a recession.

A recession is often defined as an economic slowdown or contraction that persists for two quarters (six months). The United States economy contracted during the first quarter of 2022. Although forecasters say there is a low probability (19.6 percent) the economy will contract again during the second quarter, according to a survey conducted by the Philadelphia Federal Reserve. The probability of a quarterly contraction increases (28.2 percent) in early 2023.

It's unclear whether the U.S. will experience a recession. A lot depends on the Federal Reserve’s fight against inflation, which has been made even trickier by the Russia-Ukraine War and lockdowns in China.

Weekly Focus – Think About It

“What good is the warmth of summer, without the cold of winter to give it sweetness.” —John Steinbeck, author

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.cnn.com/markets/fear-and-greed

https://www.c-span.org/video/?c4673464/user-clip-alan-greenspan-irrational-exuberance

https://www.investopedia.com/articles/01/030701.asp

https://www.investopedia.com/articles/07/ben_graham.asp

https://www.scientificamerican.com/article/what-is-loss-aversion/

https://www.investopedia.com/a-history-of-bear-markets-4582652

https://www.bankrate.com/investing/what-is-a-bear-market/

https://www.bea.gov/news/2022/gross-domestic-product-first-quarter-2022-advance-estimate

https://www.philadelphiafed.org/surveys-and-data/real-time-data-research/spf-q2-2022

https://www.economist.com/finance-and-economics/2022/05/15/global-growth-is-slowing-but-not-stopping-yet (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/05-23-22_Global%20Growth%20is%20Slowing%20But%20Not%20Stopping_11.pdf)