Weekly Market Commentary 05.09.2022

The Markets

There is a lot of uncertainty in financial markets – and markets hate uncertainty.

In recent weeks, economic and financial market data have been telling different stories – and that makes it tough for investors to know where the United States economy is headed. Since stock markets move up and down based on what investors think will happen in the future, markets have been volatile. Here are some of the issues that have contributed to recent uncertainty.

- Is economic growth slowing? At the end of April, the advance estimate for gross domestic product (GDP), which is a measure of economic growth, showed the U.S. economy contracted (-1.4 percent, annualized) during the first quarter of 2022. It was a puzzling piece of information because consumer spending, which accounts for more than two-thirds of economic activity rose by 2.7 percent during the period – after being adjusted for inflation – which suggests the economy is strong. A discrepancy between imports (up) and exports (down) appeared to be the driver behind the decline in GDP. A contraction can be a sign that the economy is weakening.

- Is economic growth continuing? Right now, workers are in demand, which can be a sign of economic growth. Last week’s unemployment report showed stronger-than-expected jobs growth in April. The unemployment rate was 3.6 percent, and average hourly earnings rose by 5.5 percent, annualized. However, the labor force participation rate – the percentage of people who are working or actively looking for work – ticked lower. This could be due to the latest wave of COVID-19, reported Patti Domm of CNBC.

- Will the Federal Reserve make a mistake? The U.S. economy recovered from the pandemic quicker than expected. One consequence was that high demand and limited supply pushed prices higher. Then inflation was exacerbated by the Russia-Ukraine war and China’s COVID-19-related lockdowns, reported Jack Denton and Jacob Sonenshine of Barron’s.

Last week, the Fed continued its fight against inflation by raising the fed-funds target rate by 0.50 percent. On Wednesday, investors welcomed the move and U.S. stock indices moved higher. On Thursday, they changed their minds and markets dropped lower. “US stocks appear to be on a permanent rollercoaster ride as investors debate continued signs of a strong economy alongside rising rates,” stated a source cited by Barron’s.

Bond yields have risen along with interest rates. At the end of last week, the 2-year U.S. Treasury note yielded 2.72 percent and the benchmark 10-year U.S. Treasury yielded more than 3 percent. Higher bond yields are likely to affect stock markets, too, as investors can now find opportunities to invest for income with less risk.

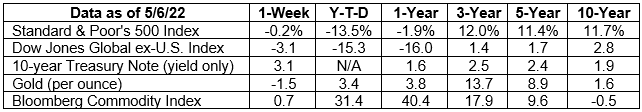

Last week, major U.S. stocks indices moved lower. The Nasdaq Composite Index is in bear market territory (down 20 percent or more), and the Standard & Poor’s 500 Index is down 14 percent year-to-date with almost half of the stocks in the Index down 20 percent or more, reported Ben Levisohn of Barron’s.

ARE YOU LIVING THE AMERICAN DREAM?

In a late March survey, conducted by an accounting technology firm, small business owners were asked if they were living the American Dream. Two-out-of-three small business owners said they were, although they thought the “American Dream” was changing. Small business owners said their American dream includes:

- Being self-made,

- Owning a business,

- Being financially comfortable, and

- Providing for their families.

They also want to:

- Provide for the future,

- Pay off a mortgage,

- Push for good causes,

- Give employees health and retirement benefits, and

- Pay employees higher wages.

According to the IRS Small Business and Self-Employed Division, there are 57 million small business owners and self-employed taxpayers that have businesses with less than $10 million in assets.9 Over the past 25 years, small businesses have accounted for two of every three jobs created in the United States, reported the Small Business Administration.

If you’re a small business owner and you would like some help with spending, saving, tax, or retirement strategies, let us know. We’re happy to help.

Weekly Focus – Think About It

“There are no forms in nature. Nature is a vast, chaotic collection of shapes. You as an artist create configurations out of chaos. You make a formal statement where there was none to begin with. All art is a combination of an external event and an internal event…I make a photograph to give you the equivalent of what I felt. Equivalent is still the best word.”

―Ansel Adams, photographer

Securities offered through LPL Financial, Member FINRA/SIPC.

* These views are those of Carson Coaching, not the presenting Representative, the Representative’s Broker/Dealer, or Registered Investment Advisor, and should not be construed as investment advice.

* This newsletter was prepared by Carson Coaching. Carson Coaching is not affiliated with the named firm or broker/dealer.

* Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

* Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

* The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

* All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. You cannot invest directly in an index.

* The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

* The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

* Gold represents the 3:00 p.m. (London time) gold price as reported by the London Bullion Market Association and is expressed in U.S. Dollars per fine troy ounce. The source for gold data is Federal Reserve Bank of St. Louis (FRED), https://fred.stlouisfed.org/series/GOLDPMGBD228NLBM.

* The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

* The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

* The Dow Jones Industrial Average (DJIA), commonly known as “The Dow,” is an index representing 30 stock of companies maintained and reviewed by the editors of The Wall Street Journal.

* The NASDAQ Composite is an unmanaged index of securities traded on the NASDAQ system.

* International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

* Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

* The risk of loss in trading commodities and futures can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. The high degree of leverage is often obtainable in commodity trading and can work against you as well as for you. The use of leverage can lead to large losses as well as gains.

* Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

* Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

* Past performance does not guarantee future results. Investing involves risk, including loss of principal.

* The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

* There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

* Asset allocation does not ensure a profit or protect against a loss.

* Consult your financial professional before making any investment decision.

Sources:

https://www.bea.gov/sites/default/files/2022-04/gdp1q22_adv.pdf

https://www.bls.gov/news.release/empsit.nr0.htm

https://www.barrons.com/articles/stock-market-today-51651825141?mod=Searchresults (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/05-09-22_Barrons_The%20Dow%20Dropped%20Again%2c%20Jobs%20Growth%20Was%20Strong_4.pdf)

https://www.barrons.com/market-data?mod=BOL_TOPNAV (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/05-09-22_Barrons_Overview_6.pdf)

https://www.barrons.com/articles/bear-stock-market-fed-china-51651870728?mod=read_next (or go to https://resources.carsongroup.com/hubfs/WMC-Source/2022/05-09-22_Barrons_This%20Stock%20Market%20Feels%20Like%20a%20Bear_7.pdf)

https://www.goodnewsnetwork.org/2-in-3-us-business-owners-are-currently-living-american-dream/